The Ultimate Saving Money App

Savings are essential in today's fast-paced world, and the Gomyfinance app offers a comprehensive solution for managing and maximizing your finances. It is designed to empower users to save money effectively while providing tools and resources to help them achieve their financial goals. In this article, we will delve into the features of Gomyfinance, explore how it works, and discuss its benefits, making it a must-have app for anyone looking to improve their financial health.

We understand that managing finances can be overwhelming, especially with the multitude of saving strategies available. Gomyfinance simplifies the process by offering an intuitive interface and smart features that cater to both seasoned savers and beginners. By the end of this article, you will have a clear understanding of how Gomyfinance can transform your saving habits and bring you one step closer to financial freedom.

Join us as we explore the various aspects of the Gomyfinance app, including its unique features, user experience, and tips for maximizing your savings. With the right tools and knowledge, you can take control of your financial future and make your savings work for you.

Table of Contents

What is Gomyfinance?

Gomyfinance is a cutting-edge saving money app designed to help users manage their finances efficiently. It provides a platform for users to track their spending, set saving goals, and develop personalized financial strategies. The app integrates various financial tools to ensure users can achieve their savings goals while maintaining control over their finances.

Data and Personal Information

| Data Point | Details |

|---|---|

| App Name | Gomyfinance |

| Launch Year | 2021 |

| Target Audience | Individuals looking to save money |

| Platforms Available | iOS, Android |

| Website | gomyfinance.com |

Key Features of Gomyfinance

The Gomyfinance app comes equipped with several key features that make it stand out among other saving money apps in the market. Here are some of its most notable attributes:

- Goal Setting: Users can set specific savings goals and track their progress over time.

- Spending Tracking: The app allows users to monitor their spending patterns, providing insights into areas where they can cut costs.

- Budgeting Tools: Gomyfinance offers budgeting features that help users allocate their income towards savings and expenses.

- Automated Savings: Users can enable automated transfers to their savings accounts based on their preferences.

- Financial Education Resources: The app provides educational content to help users make informed financial decisions.

How to Use Gomyfinance Effectively

To get the most out of Gomyfinance, follow these steps:

Step 1: Download and Set Up the App

Download the Gomyfinance app from the App Store or Google Play Store and create an account using your email address or social media accounts.

Step 2: Define Your Savings Goals

Identify what you want to save for, whether it's an emergency fund, a vacation, or a major purchase. Set a realistic target date and amount for each goal.

Step 3: Monitor Your Spending

Link your bank accounts to the app to track your spending seamlessly. Regularly review your expenses to identify areas where you can save more.

Step 4: Use Budgeting Tools

Utilize the budgeting features to create a monthly budget that aligns with your savings goals. Adjust your spending habits accordingly.

Benefits of Using Gomyfinance

There are numerous benefits to using Gomyfinance, including:

- Improved Financial Awareness: By tracking your spending and savings, you gain insight into your financial habits.

- Personalized Savings Plans: The app tailors strategies to help you meet your financial objectives.

- Convenience: Gomyfinance streamlines the saving process with its user-friendly interface and automated features.

- Educational Support: Access to a wealth of information helps you make better financial decisions.

User Experience and Reviews

Users have praised Gomyfinance for its intuitive design and functionality. Many reviews highlight the app's ability to simplify saving and budgeting, making it accessible to everyone. Here are a few user testimonials:

- "Gomyfinance has completely changed the way I save. The automated features make it so easy!"

- "I love the goal-setting feature. It keeps me motivated to save more each month."

- "The spending tracker opened my eyes to my habits, and now I save much more than I used to."

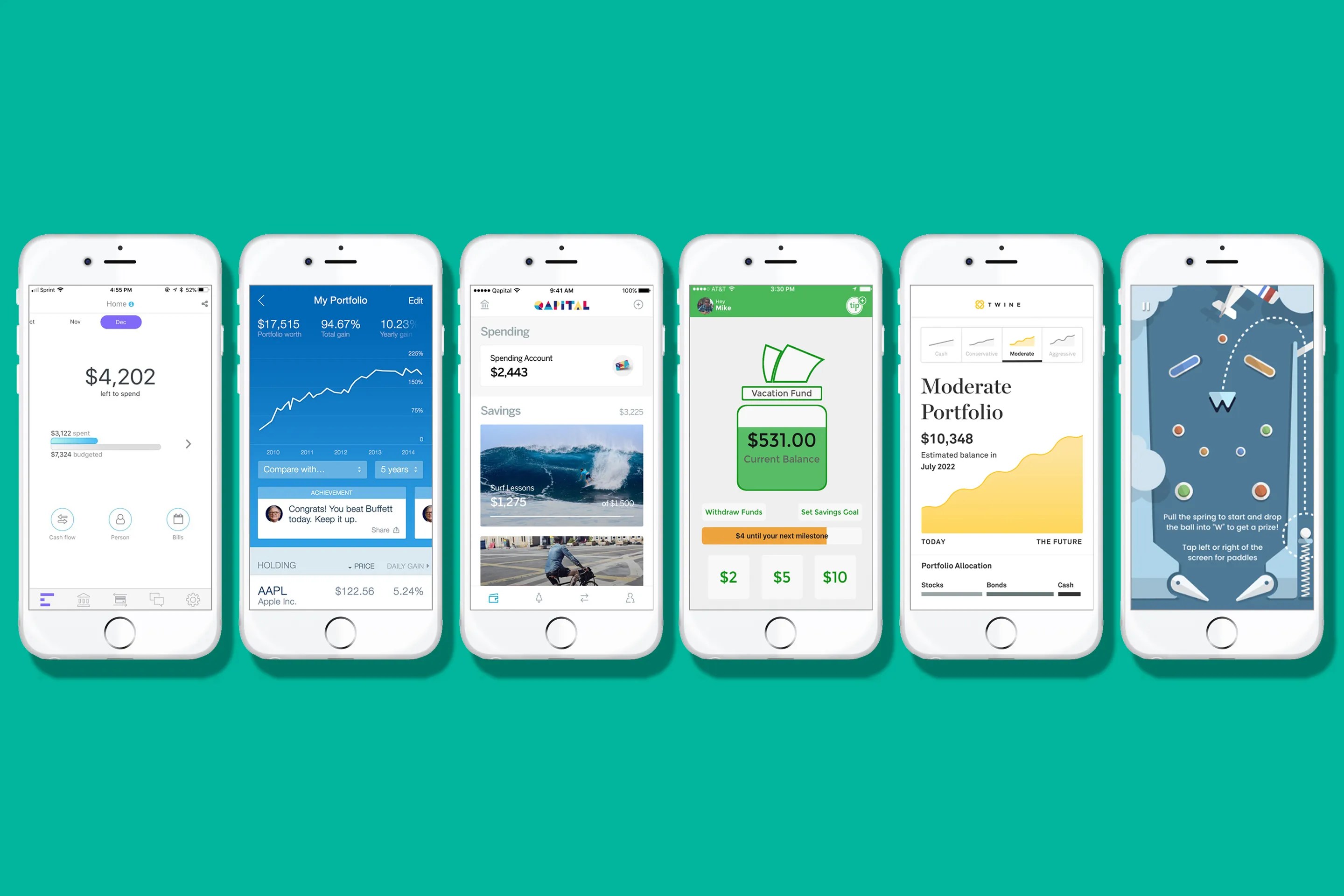

Gomyfinance vs. Other Saving Apps

When compared to other saving apps, Gomyfinance stands out for its comprehensive features and user-friendly interface. Here's how it compares:

- Simplicity: Gomyfinance is easier to navigate than many competing apps.

- Customization: The app offers personalized savings plans tailored to individual needs.

- Community Support: Users can connect with others for tips and motivation, a feature some apps lack.

Tips for Maximizing Your Savings

To make the most of your Gomyfinance experience, consider the following tips:

- Regularly review your expenses to identify areas for improvement.

- Set specific and achievable savings goals.

- Take advantage of the app's budgeting tools to keep your spending in check.

- Engage with the educational resources offered to enhance your financial literacy.

Conclusion

In conclusion, Gomyfinance is a powerful saving money app that provides users with the tools they need to manage their finances effectively. Its unique features, user-friendly design, and educational resources make it an excellent choice for anyone looking to improve their financial health. If you're ready to take control of your savings and achieve your financial goals, download Gomyfinance today and start your journey towards financial freedom!

ncG1vNJzZmivp6x7o77EnKKepJxjwqx7zaiurKyimq6ugI6gpqaxlp67orrCnmScp51iwKLCyKeeZqWfo7K6ecCpp2egpKK5